costa rica taxes vs us

9 147 593 km². The tax increases slightly each year and is due annually at the end of January.

In Tax Gender Blind Is Not Gender Neutral Why Tax Policy Responses To Covid 19 Must Consider Women Ecoscope

In Costa Rica income tax rates are progressive.

. Owners of Costa Rica real. GDP PPP constant 2005 international. The import tax charged on a shipment will be 13 on the full value of your items.

2022s tax was 69330 approximately US109 per inactive corporation. Single and 65 or older. In Costa Rica you might actually have to pay luxury task on your property.

For US income tax purposes these are corporations and must be reported on Form 5471. Costa Rica ranked 80th vs 6th for the United States in the list of the most expensive. There are an estimated 50000 Americans living in Costa Rica.

In case of legal entities income tax ranges. The average cost of living in Costa Rica 893 is 1 less expensive than in the United States 2112. The answer to your questioncan you fly to Costa Rica without a passportis essentially a no no matter where you are from.

The maximum tax rate of 15 percent for employment income and 25 for. Costa Rica calculates tax differently for different types of income. Income tax rates for both companies and individuals are calculated on a progressive scale depending on gross income.

Income taxes on individuals in Costa Rica are levied on local income irrespective of nationality and resident status. For example if the declared value of your items is. PPP GDP is gross domestic product converted to international dollars using.

Up to 80 cash back The Tax Free Threshold Is 0 USD. Randall Linder of US. Non-residents including Americans who spend less than 183 days a year in Costa Rica are also subject to a.

The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year. When property is purchased in Costa Rica it. If you are from the United States.

Income subject to tax in this country includes employment income self-employment business income. The countrys total land area excluding inland and sea waters. Income GDP PPP Constant 2005 international per capita.

Now this tax applies to houses condos and apartments whose value of construction. Last reviewed - 03 February 2022. The penalty for failing to file Form 5471 can be 10000 or more.

Taxpayers are required to file for taxes if their income exceeds a certain amount. To get a better idea of how large the country is you can compare it with a soccer.

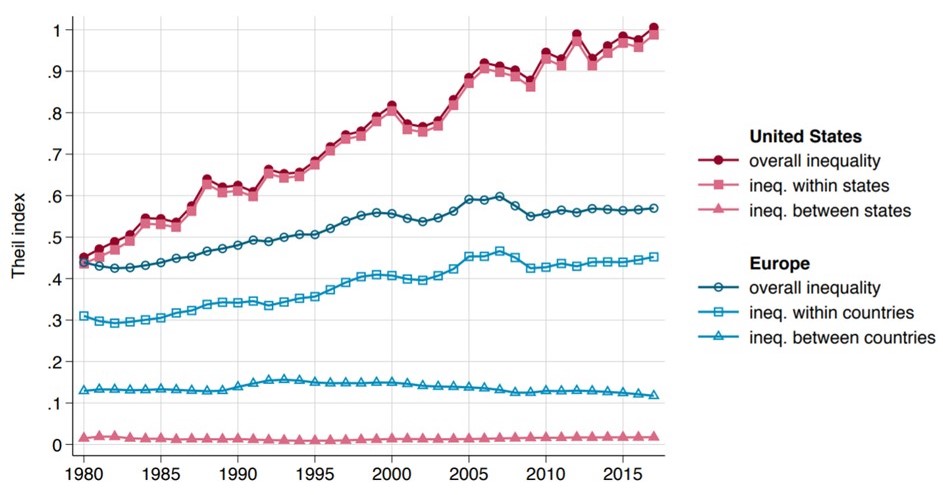

Why Is Europe More Equal Than The United States Wid World Inequality Database

Simple Tax Guide For Americans In Costa Rica

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

Costa Rica Demographic Trends Britannica

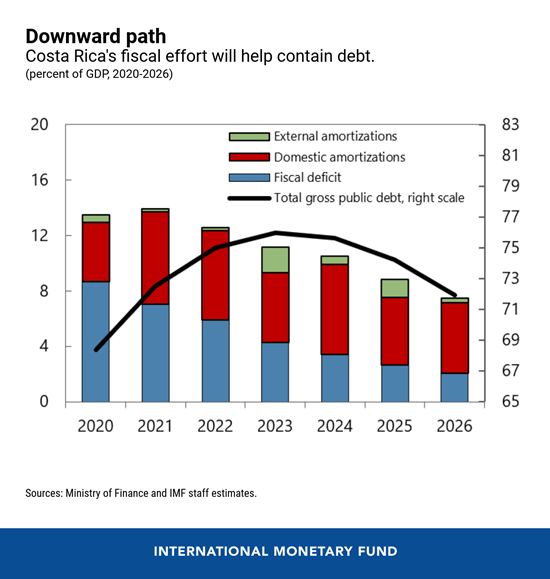

Costa Rica Is Struggling To Maintain Its Welfare State The Economist

Taxation In The United States Wikipedia

The Dark Side Of Costa Rica Why Expats Leave Badass Digital Nomads

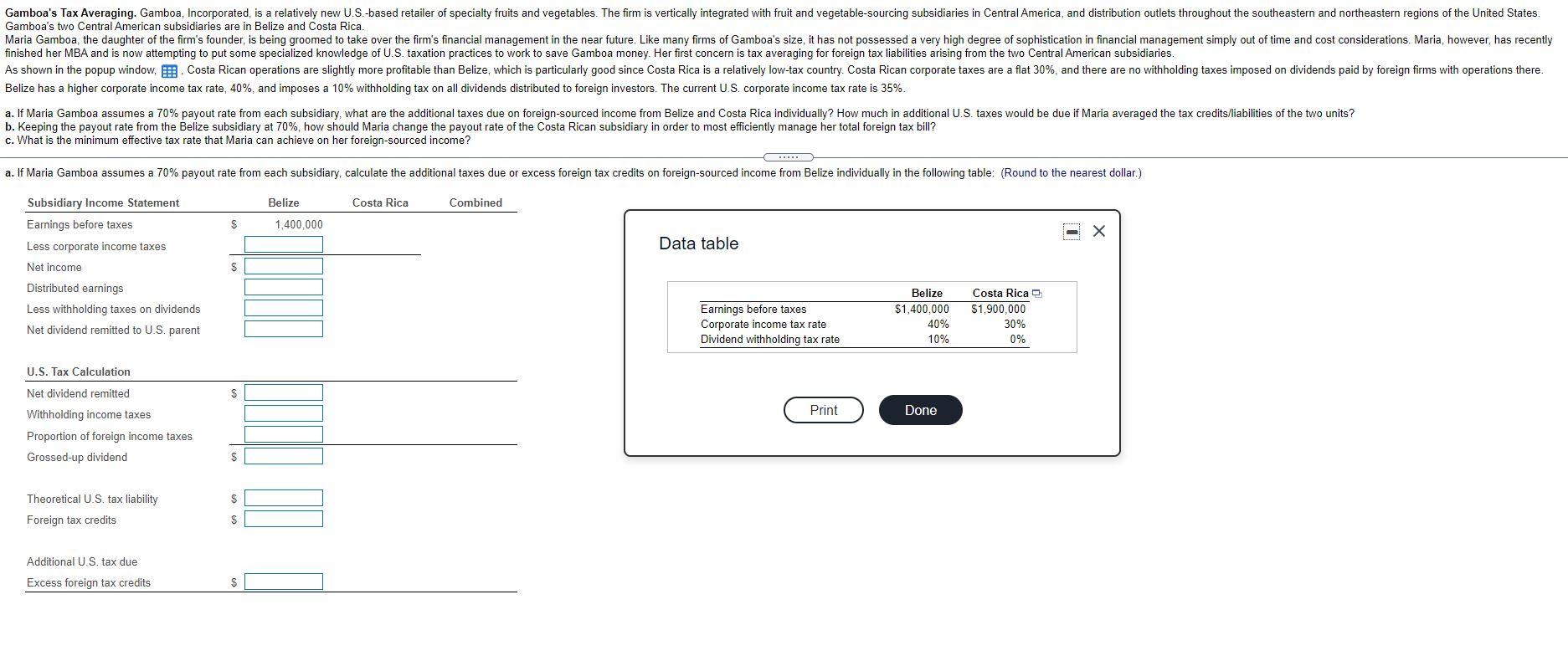

Gamboa S Tax Averaging Gamboa Incorporated Is A Chegg Com

How To File Us Income Taxes When Living In Costa Rica Online Taxman

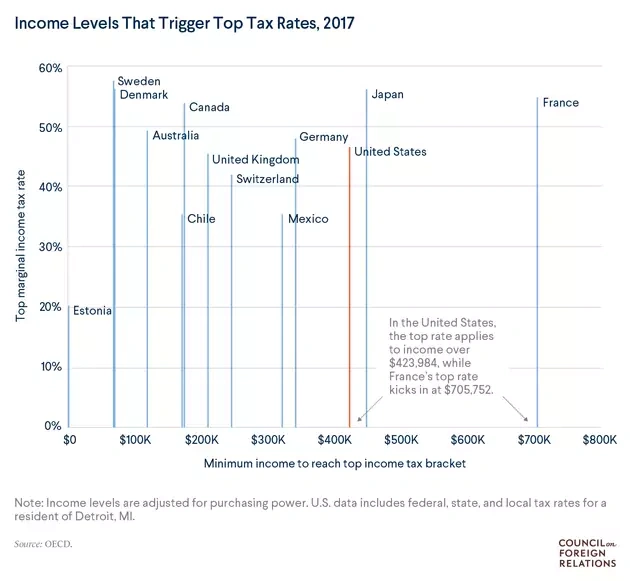

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Costa Rica S President No Growth And Poverty Reduction Without Economic Stability

Costa Rica Gdp Per Capita Ppp Data Chart Theglobaleconomy Com

Costa Rica Resources And Power Britannica

Costa Rica Cost Of Living 2022 How Much To Live In Costa Rica

U S Public Opinion And Increased Taxes On The Rich

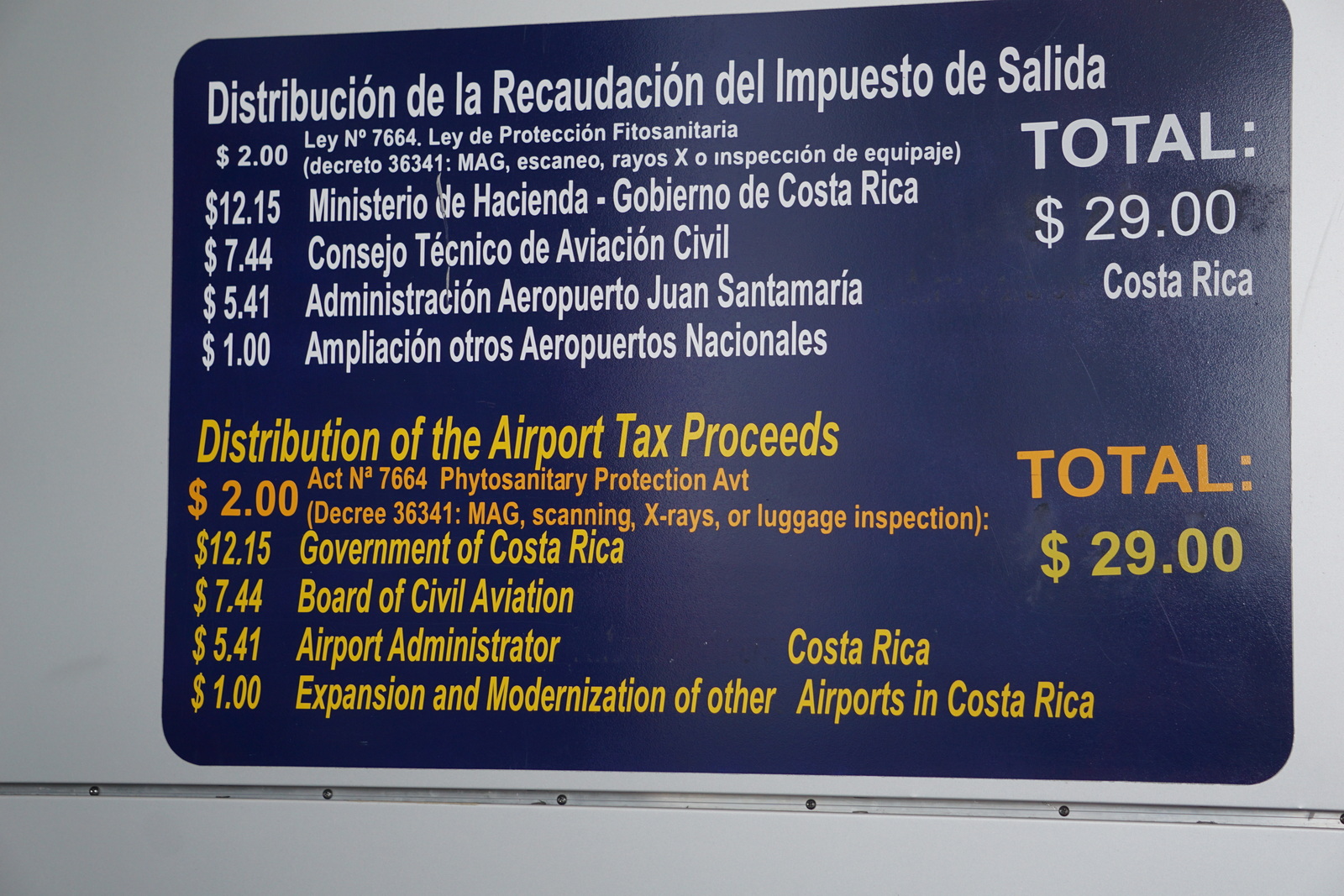

Departure Tax Exit Tax Changed In 2018 Or Maybe Not

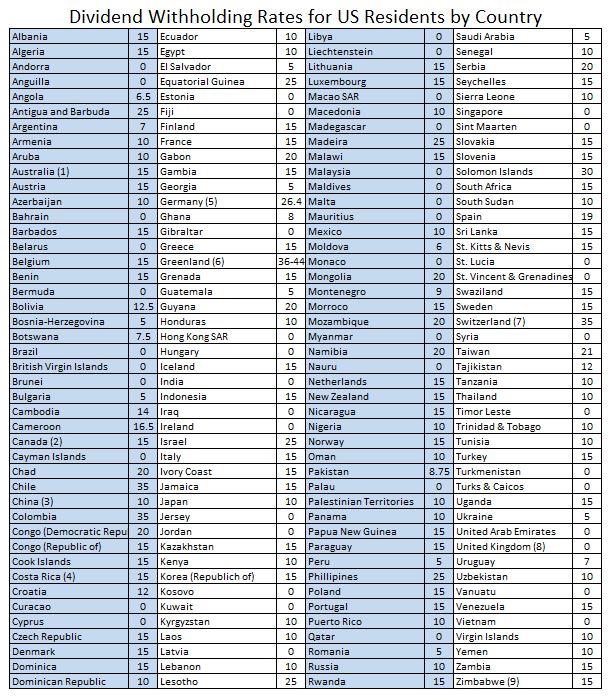

Things To Consider Before Investing In Foreign Dividend Stocks Seeking Alpha

Us Taxes For American Expats In San Jose Costa Rica Bright Tax